Sales Tax & Use Tax

Nevada Sales Tax & Use Tax are two closely related aspects of Nevada’s taxation system, primarily aimed at taxing the consumption of goods and services within the state.*

Click here for Spanish: Sales and Use Tax General Information

*Note: To pay your Sales & Use Tax go to My Nevada Tax.

About Nevada Sales & Use Tax

Sales & Use Tax are imposed on the sale, transfer, barter, licensing, lease, rental, use or other consumption of tangible personal property in Nevada. Sales/use legislation was initially enacted in Nevada in 1955. See also Consumer Use Tax FAQs.

Nevada Sales Tax

Sales tax is a tax on the sale of goods and services within Nevada. It is collected by businesses at the point of sale and then remitted to the state.

Nevada Consumer Use Tax

Consumer Use Tax complements Sales Tax and applies to the use, storage, or consumption of goods within Nevada when Sales Tax has not been paid. This typically applies to items purchased from out-of-state vendors for use in Nevada.

Sales & Use Tax Forms and Instructions

RETAILER/WHOLESALER/MANUFACTURER: Sales & Use Tax Return:

English PDF || Spanish PDF

- Effective January 1, 2020 the Clark County Sales and Use Tax rate increased to 8.375%. This is an increase of 1/8 of 1 percent on the sale of all tangible personal property that is taxable. In the 2011 Legislative Session reduced the interest rate to 0.75% (or .0075) from 1% (or .01) effective 7/1/2011.

- The correct tax rates will display based on the period end date selected. The return will calculate penalty and interest based on the Date Paid field. For returns filed and paid within 30 days of the due date, the penalty calculation is a graduated scale per NAC 360.395. Instructions are included following the return.

- Who should use it: Retailers, Wholesalers & Manufacturers who sell taxable tangible personal property and are required to collect Sales Tax.

- Purpose: To report and remit both Sales and Use Taxes collected from customers.

- Frequency: Can be filed:

- Monthly- mandatory if taxable sales are more than 10K per month.

- Quarterly- if less than $10,000 per month.

- Annual- if less than $1,500 sales in previous year.

ONE-TIME Sales Tax Return: PDF

- Effective January 1, 2020 the Clark County Sales and Use Tax rate increased to 8.375%. This is an increase of 1/8 of 1 percent on the sale of all tangible personal property that is taxable.

- The 2011 Legislation Session pursuant to AB 504, reduced the interest rate to 0.75% (or .0075) from 1% (or .01) effective 7/1/2011. The correct tax rates will display based on the period end date selected. This form will calculate penalty and interest based on the Date Paid field.

- For returns filed and paid within 30 days of the due date, the penalty calculation is a graduated scale per NAC 360.395. Instructions are included following the form.

- Who should use it: This is the standard Consumer Use Tax Return for businesses that do not sell, don’t require a seller’s permit, such as construction contractors and individuals who have not paid Sales Tax on their purchases.

- Purpose: To report only Consumer Use Taxes

- Frequency: *A return must be filed even if no tax liability exists*

Other Forms Regarding Sales & Use Tax

Application for Sales Use Tax Exemption:

English PDF || Spanish PDF

- Who should use it: Religious, charitable, or educational organizations seeking an exemption from Sales and Use Taxes.

- Purpose: To apply for legal exemption from Sales and Use Taxes for qualified organizations.

Application for Contractor Refund - Prior to January 2020:

English PDF || Spanish PDF

- Who should use it: A contractor or subcontractor and have open contracts entered into before January 1, 2020

- Purpose: You may be entitled to a refund from the increase in sales tax upon approval from our Department.

Tourism Improvement District Semi-Annual Report:

English PDF || Spanish PDF

- Who should use it: Businesses operating within or doing business in a Tourism Improvement District (STAR Bond District).

- Purpose: To report activities and applicable transactions within the Tourism Improvement District.

Vessel Trade In Trade Down Supplemental Reporting Form:

English XLSX || English PDF || Spanish PDF

- Who should use it: Businesses involved in the trade-in or trade-down of vessels.

- Purpose: To document and report transactions involving the trade-in or trade-down of vessels, ensuring compliance with tax changes reflected after the 2009 Legislative Session.

Resale Certificate: English PDF || Spanish PDF

- Who should use it: Holders of a Sales Tax permit who purchase items intended for resale.

- Purpose: To avoid paying Sales Tax on items that will be resold, as these items will eventually be taxed at the point of sale to the final consumer.

Marketplace Facilitator Certificate of Collection (PDF)

- Who should use it: Marketplace Facilitators who facilitate sales on behalf of Marketplace Sellers.

- Purpose: To certify that the facilitator is registered with the Department of Taxation and will collect and remit Sales Tax on sales facilitated on behalf of sellers.

- Marketplace Facilitator/Seller FAQs

Nevada Business Registration:

English PDF || Spanish PDF

- Who should use it: Business owners who want to register a business in Nevada.

- Purpose: This form is necessary for obtaining a Sales Tax/Use Tax Permit.

Payment Agreement Guaranty:

English PDF || Spanish PDF

Statement of Purchaser of Bailing Wire or Twine:

English PDF || Spanish PDF

Application for Voluntary Disclosure of Failure to File Return:

English PDF || Spanish PDF

- Who should use it: Taxpayers who want to voluntarily disclose unfiled returns before the Department initiates an audit or investigation.

- Procedure: The taxpayer or representative must complete the application for voluntary disclosure available on the Department’s website.

One-Time Event Information: English PDF

- Who should use it: Specifically for promoters organizing one-time events.

Request for Waiver of Penalty & Interest:

English PDF || Spanish PDF

- Who should use it: Taxpayers that fail to make a timely return or payment due to circumstances beyond their control.

- Procedure: Requires detailed facts and supporting documentation to substantiate the request for waiver or reduction of penalties and interest.

Surety Bond Acknowledgement:

English PDF || Spanish PDF

*Chapters 372, 374, 377, 377A and 377B

- Who should use it: Used when a sales tax permit requires a surety bond as security.

- Procedure: This form should be provided to your insurance carrier to arrange the bond.

Streamlined Sales & Use Tax (SST)

SST was established in response to complexities in state sales tax systems that were highlighted by a U.S. Supreme Court decision regarding tax collection by sellers without a physical presence in the state.

The goal of SST is to simplify and modernize Sales and Use Tax administration, reducing the burden of compliance across various types of commerce. Nevada became a full member of the Streamlined Sales and Use Tax Governing Board on April 1, 2008.

- Who should use it: Sellers without a physical presence in Nevada.

- Nevada's Recertification Letter - Section 803

- Nevada’s SST Certificate of Compliance

- SST Certified Service Providers

- Nevada Taxability Matrix

- Downloadable Rates and Boundary Database Files and Instructions

- Streamlined Sales and Use Tax Governing Board

- SST Certificate of Exemption (PDF) || Instructions

- Remote Seller Information (SST Governing Board)

- Remote Seller Guidelines (SST Governing Board)

Under Nevada Revised Statutes (NRS) 360.263 and related regulations, the Nevada Tax Commission (NTC) offers taxpayers the possibility to negotiate a compromise on their tax liabilities. This process, known as an Offer in Compromise (OIC), allows taxpayers to settle their tax debts for less than the full amount owed under certain conditions.

- Request for Offer in Compromise (OIC): PDF

- Waiver of Limitations - Offer in Compromise: English PDF || Spanish PDF

- Eligibility: The OIC applies to various taxes, fees, contributions, premiums, and penalties, except for property taxes.

- Who should use it: Taxpayers who need to settle tax liabilities when full payment is in doubt or collection would cause undue hardship.

- Written Request: Taxpayers must submit a written request for an OIC, detailing why they are seeking a compromise.

- Waiver of Limitations: As part of the application, taxpayers must sign and submit a Waiver of Limitations, agreeing to suspend any statutory periods for collecting the liability during the OIC process.

- Grounds for Compromise:

- Doubt as to Collectability: Suitable for taxpayers who cannot pay the full amount.

- Requires completion of a Personal Financial Statement and, for businesses, a Financial Information Statement.

- Documents must be submitted within 30 days, with all required verifications.

- Doubt as to Liability:

- For taxpayers who dispute the amount they owe.

- Requires a detailed written explanation and relevant verifications, but no financial statements.

- Verification must be submitted within 30 days.

- Consideration of Equity and Fairness:

- Applies in cases of hardship or other exceptional circumstances.

- Requires financial statements and verifications of the circumstances, submitted within 30 days.

- Decision Process:

- Notification: Applicants are notified upon receipt of their request.

- Review: The NTC reviews the application, considering the taxpayer’s compliance history and the specifics of the case.

- Acceptance: If accepted, an OIC may include an installment agreement. The compromised debt is considered settled in full, although the NTC may still collect any remaining liability from other liable individuals.

- Additional Information:

- Status of Further Collections: No further collection activities will occur while the OIC is being processed, provided that the application is under consideration and until a decision is made.

- Rejection and Continuation of Collections: If an OIC is not accepted or if required documentation is not provided or is incomplete, the NTC will resume collection activities.

Tax Rates

Sales Tax

Sales Tax applies to most retail sales of goods and many services. Certain items like food for home consumption and prescription medications are typically exempt.

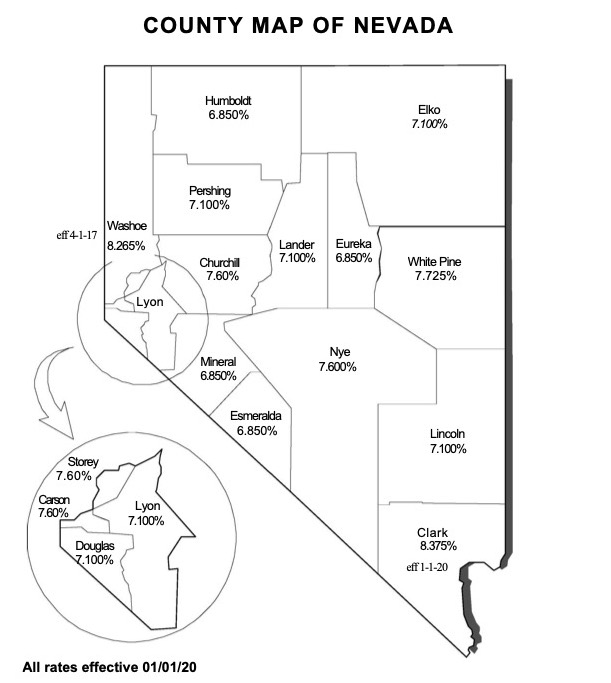

- State Sales Tax Map - This also includes an alphabetical list of Nevada cities and counties, to help you determine the correct tax rate.

- Components of Sales Tax

- Rate Sheets: The base State Sales Tax rate in Nevada is 6.85%. However, local jurisdictions can add additional taxes, which can make the total Sales Tax rate vary significantly from one area to another.

- Carson City 7.60 Tax Rate Sheet - effective 10/1/2014

- Churchill & Storey Counties 7.60 Tax Rate Sheet - effective 7/1/2009

- Clark County 8.375 Tax Rate Sheet - effective 1/1/2020

- Douglas County 7.10 Tax Rate Sheet - effective 7/1/2009

- Elko County 7.10 Tax Rate Sheet - effective 7/1/2016

- Lander County 7.10 Tax Rate Sheet - effective 7/1/2009

- Lincoln County 7.10 Tax Rate Sheet - effective 7/1/2009

- Lyon County 7.10 Tax Rate Sheet - effective 7/1/2009

- Nye County 7.60 Tax Rate Sheet- effective 4/1/2014

- Nye County 7.10 Tax Rate Sheet - from 7/1/2009 through 3/31/2014

- Pershing County 7.10 Tax Rate Sheet - effective 7/1/2009

- Washoe County 8.265 Tax Rate Sheet - effective 4/1/2017

- White Pine County 7.725 Tax Rate Sheet - effective 7/1/2009

Consumer Use Tax

- Rate: The Consumer Use Tax rate is the same as the Sales Tax rate applicable in the buyer’s local area, including any local surcharges.

Additional Information

- Sales Tax FAQs

- Consumer Use Tax FAQs

- Streamlined Sales Taxability Matrix

- R056-18 is a regulation revising provisions governing the determination of whether food sold by a retailer is prepared food intended for immediate consumption for the purposes of the imposition of Sales and Use Taxes on the retail sale of the food; and providing other matters properly relating thereto. To see the Adopted Regulation - see this link on the Law & Regulations page under Adopted Regulations: R056-18A When is Consumable Food Exempt or Taxable

- End of Penny Production - The U.S. federal government ended production of the one-cent coin (“penny”) in June 2025, citing rising production costs—now exceeding two cents per coin—and declining practical use. Existing pennies will remain legal tender indefinitely. Retailers and financial institutions will receive a transition period to adjust pricing and accounting systems. While the Department is not issuing guidance to retailers on how to adjust pricing, many states have recommended that retailers round cash transactions to the nearest five-cent increment. The Department does not accept cash for the payment of taxes except in very limited circumstances. However, if a retailer has rounded a cash transaction, please note that Sales and Use Tax (SUT) must be calculated on gross receipts (NRS 372.110). “Gross receipts” is defined as the total amount received from the sale (NRS 372.025). This policy ensures accuracy in taxation and fairness in consumer transactions.

More Information

- Bank Branch Excise Tax

- Cannabis Tax

- Cigarette and Other Tobacco Products (OTP) Tax

- Commerce Tax

- Exhibition Facility Fee

- Gold and Silver Excise Tax

- Insurance Premium Tax

- Liquor Tax

- Live Entertainment Tax (LET)

- Lodging Tax

- Modified Business Tax (MBT)

- Net Proceeds of Minerals Tax

- Peer-to-Peer Car Sharing Fee

- Property Tax

- Real Property Transfer Tax (RPTT)

- Sales Tax & Use Tax

- Short Term Lessor Fee Tax

- Tire Surcharge Fee

- Transportation Connection Tax (TCT)

- Consumer Use Tax